本文是一篇工商管理论文,工商管理专业学生主要学习管理学、经济学、企业运营管理等方面的基本理论和基本知识,受到管理学、企业战略管理、企业运营管理及创业管理方面的基本训练,具有分析和解决企业管理问题的基本能力。(以上内容来自百度百科)今天为大家推荐一篇工商管理论文,供大家参考。

Chapter 1: Introduction

To sum up this chapter, it is very important to achieve to a better organizationalperformance, therefore the financial institutions must focus on the indicators that will optimizethe performance of the company. Information system is very crucial to get access to the datainternally and externally. In addition if the information systems are well managed in thecompany this means that it will be easier to take a managerial decision which will affect theproductivity of the company.

1.1. Background

In modern times, the administration has faced a state of challenge as a result of thescientific and technological revolution. Therefore, in all fields, the means and complexity ofmanagement tasks and the requirements of their traditional performance in adopting personalexperience and even methods of trial and error are no longer able to achieve the Organization'sobjectives informed decisions in the field of optimal investment of human resources, materialand financial available. The decision-making process has become the core of the managementprocess and its primary means of achieving the objectives of the organization. As it is a commonfactor for all administrative functions (planning, organizing, directing and controlling all aspectsof the organization's organizational structure) for the objectives of the organization, aspects of itsactivities, the size that reached, its capital, as well as the numerous operational processes thathence has become imperative to focus on managers. All Principles and methods of decision-making are practiced within the principles and procedures for the implementation of decisions(Ismail, 2004).The technological development witnessed by organizations in this era, as well as the sizeof the institutions and their geographical expansion to multiple regions and their transition to thestage of multi-nationality. The globalization and the emergence of the concepts of globalization,and the complexity of the relations gradually, both members of one organization or between theorganization and others, factors have made the task of decision-making in the modern enterprisemore difficult, and increased the workload and responsibility borne (Saudi, 2006).

.........

1.2. Research questions:

The research questions are the followings:To what extent can MIS increase the effectiveness of decisions making andorganizational performance at private banking sector in Djibouti?In order to answer the research question above, the following research sub-questions have beengeneralized as: How effective are the decisions in the private banking sector in Djibouti? How does the introduction of information systems affect the organization of work andoperating decisions of banks? How well is the Bank Information Systems used for quantitative methods of decision-making? To what extent do the current information systems serve the strategic objectives ofprivate banks?

.........

Chapter 2: Study domainI

2.1. Introduction in Djibouti and in the Finance Sector in General

In 2014 Djibouti’s economy achieved a growth rate of nearly 6%, according to estimatesfrom the African Development Bank. While unemployment remains a challenge, this growthfigure, coupled with a young and expanding population, points to the strong potential of thecountry. Ports, logistics and associated services remain the dominant economic activity,accounting for more than 90% of GDP, though Djibouti also has some natural advantages. Interms of metals and minerals, the country is home gold, granite, limestone and marble deposits.Djibouti is also looking to leverage its significant geothermal resources to satisfy domesticenergy demand. According to World Bank estimates, the country’s population reached 876,200in 2014 – the majority of which, more than 500,000 people, live in the capital, Djibouti City.Djibouti is also a young country, with more than half of the population under the age of 25. Thetwo official languages are French and Arabic; however, with the ethnic composition of thecountry consisting mostly of Somalis (50%) and Afars (45%), these groups’ languages are alsowidely spoken. Djibouti is a relatively young country in political terms. It achievedindependence less than 40 years ago and has had just two presidents in that time. Djibouti’scomparative stability in an otherwise volatile region has allowed the country to developrelatively quickly.

........

2.2. The Bank Sector in Djibouti

Djibouti's banking sector, which features both Islamic and conventional banks, has grownsignificantly in recent years and saw the arrival of new banks bringing the number of institutionsto 11, compared with only two in 2006. The sector remains highly profitable with low level ofnonperforming loans (approximately 6 percent). Even so, the sector remains very concentrated,with two main banks accounting for 85% of assets. Under newly enacted directives, all publicand private sector employees earning more than FDJ 40,000 are required to hold a currentaccount in banking institutions; a move which has led to an important increase in bank deposits.Between 2008 and 2009 commercial bank deposits increased by 19.3 percent to reach FDJ 183.9billion, while sight deposits rose by 34.8 percent and bank balance sheets improved by 20.7percent. However, weak enforcement of creditor rights and the absence of comprehensive information on borrowers keep lending risks high. Bank lending has increased in recent years butstill remains fairly limited, with the ratio of bank credit to bank deposits rising from 29.5 percentin 2006 to 37 percent in 2008 and 41.6 percent in 2009.

.........

Chapter 3: Theoretical overview.........11

3.1. Stakeholder theory..........11

3.2. Decision-making theory.............13

Chapter 4: Hypothesis...............15

4.1. The concept of information systems......15

4.2. The concept of decision-making............19

4.3. Organizational performance.......27

4.4. Banking Information Systems....29

4.6. Hypothesis..........32

Chapter 5: Research design.......34

5.1. Study Population and Data Collection...............34

5.2. Research methodology design....34

5.3. Company’s profile: ........34

5.3.1. Profile of the Surveyed Banks.............34

5.3.2 Profile of the Respondents.......36

5.4. Constructs Operationalization....39

5.5. Data analysis......41

Chapter 7: Majoring findings and Conclusions

7.1. Major findings

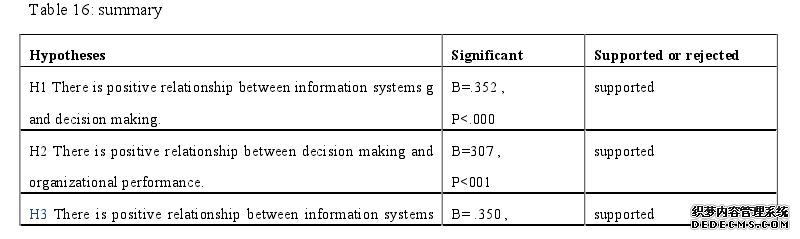

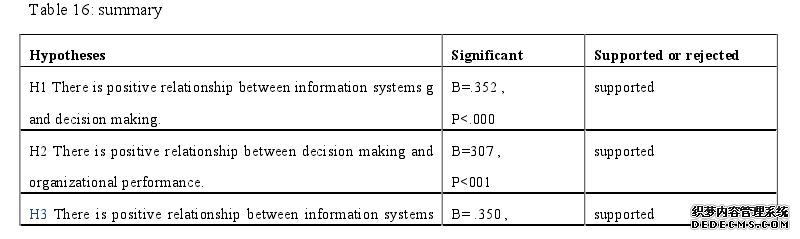

After the presentation of the most important theoretical concepts related to informationsystems and their relation to decision-making in the organization, and after analyzing thehypotheses of the study through a field study of the private banks in Djibouti, it was possible toreach a number of results can be presented as follows: The average age of decision makers in the company tends to middle age groups (25 to 45years). The decision makers in the company have an acceptable level of education, and sufficientto accept and understand the idea of introducing computer-based administrativeinformation systems and relying on them to support the decision-making process. The decision makers in the company have sufficient experience in the sector, and in thecompany in question, in particular, which makes it easier to take advantage of computer-based management information systems in decision-making, thus increasing itseffectiveness. The management information systems adopted by the company in question contributegreatly to increasing the accuracy of information in the company, and provideinformation, most of which is necessary to make decisions in a relatively fast time. It alsogives a better form of information which facilitates the handling and utilization of them.It also contributes to making the information more quantifiable. The MIS in Organization and its subsystem to decision making is helpful to bringdramatic change in organizational hierarchy.These findings above are related to the descriptive analysis, concerning the hypotheses the threehypotheses were supported and have an impact on organizational performance.

........

Conclusion

The process of decision-making has become very important in the modern era, especiallyafter the economic establishments are operating with many resources, huge equipment and investlarge sums of money. The decision-making process in the area of business management hasbecome the real engine of the activity of organizations and the point of departure towardsachieving the desired goals, resulting in many intellectual contributions in this field. The abilityof any institution to achieve its objectives depends on its success in planning and organizing itswork, managing its resources and staff and coordinating them, while effectively monitoring itsvarious actions. This makes it necessary for the Organization to provide accurate, appropriate,comprehensive, integrated, timely and cost-effective information because it is the basis for theadoption of rational decisions. The rapid development of the volume and types of informationthat is traded in the institution led The latter to search for a system that would control thequantity of information stored, processed, disseminated and retrieved, thereby ensuring theavailability of information required for management levels so that it could make its decisions inthe best possible manner. Information systems had evolved considerably in line withtechnological development, the simple manual system to neural networks and expert systems,and the emergence of the concept of artificial intelligence as an alternative to man in manyaspects of planning and control. The more information management systems can achieve a highlevel of synergy between the systems of modern IT components and programs, the more they canachieve the proven strategic competitive advantage that can only be achieved through theacquisition and production of value-added information to the total value of the organization'sproducts, goods and services.#p#分页标题#e#

..........

References (abbreviated)