CHAPTER 1 INTRODUCTION

1.1 Overview

The research empirically examines the micro and macroeconomic determinants ofearnings and earnings quality of banks by using profitability to evaluate the earningsand accounting conservatism with earnings persistence to examine the earnings quality.To determine the profitability of banks, I used micro economic and macroeconomicvariable and find some relevant results that are very important to investors andresearchers. To examine the earnings quality, I used the two most important attributes,accounting conservatism and earnings persistence, and then investigate the effect ofdifferent microeconomic and macroeconomic factors effect on these two. These resultsgive the new insight as this is first study which is using Pakistani banking sectors datafor earnings and earnings quality.The theory of earnings quality has attracted substantial consideration of financiers,managers and scholars lately in the rouse of main corporate scandals in the UnitedStates (US) such as Enron, WorldCom and HealthSouth. In an effective capital market,stock prices modify to new information. Information inadequacies can influence stockprices and price finding. The worth of accounting information (or accounting quality) isone such information which can influence stock prices and price. Accounting quality isthe accuracy with which financial reports deliver information to investors about theorganizations predictable cash flows (Dechow et al, 2010).There is no official sketch available in accounting works of what categorizesaccounting quality (Verleun et al. 2011). It is also a mysterious idea because ofnumerous uses of financial reports (Chen et al. 2010). Nevertheless, the users ofaccounting information recognize the conception of accounting quality however theirthoughts might be improved (Eugene, 1988). The central determination behind theaccounting quality is improved reliability; transparency and quality of financialreporting development (Waroonkun and Ussawanitchakit, 2011). Accordingly, earningsquality can light the main objective of financial reporting that delivers the handyinformation to investors, creditors and other users to weigh the firm’s cash flowscenarios (Entwistle and Phillips, 2003).

.......

1.2 Contributions of study

Many studies from different countries in different time period have contributed tothe understanding of earnings and earnings quality. Many factors that are affecting the profitability of banks have been identified and examined. There are also differentattributes to earnings quality has been studied by different researchers. Although priorliterature provide much valuable knowledge in the area but many questions and factorsstill remained unknown and unanswered. Various prior researches lead to inconsistentand even controversial results and also many important factors are missing. Now day’sscholars those are studying bank profitability and earnings quality are attempting tofollow a more comprehensive and build more conceptual model to overwhelm theweaknesses from prior researches. It is time to put pieces of mysteries together andcreate a clearer picture of earnings and earnings quality. While it is also a fact that wecannot put all the factors and consequences in the one research because of accessibilityof different data is very difficult, but can be developed new conceptual work that caninclude few new factors, also can be include some other countries, which have lessresearch environment. To find out some missing factors about the determinant ofearnings and earnings quality, I used the data from Pakistan banking sector, on whichthere are few researches has been done that of course did not shows the clearer pictureabout the determinant of earnings and earning quality.

.......

CHAPTER 2 THEORETICAL BACK GROUND

2.1 Function of Banks

To start very simple, this passage deliberates the tenacity of banks in the economyand sees the question why banks exist. . At first view, the response to this question isvery artless and simple; banks act as an intermediary between those who are in want formoney and those who have additional of money. Noting more carefully to this questionthere could be a more inclusive explanation. Namely, in a perfect capital market ofModigliani-Miller (MM), financial institutions are nonessential (Santos, 2001); namely,individuals can borrow and save directly through the money market. In truth, suchperfect market has no existence; transaction costs and monitoring costs distort capitalmarkets. Furthermore, capital markets suffer from the information asymmetry and theagency problem. The agency problem refers to the dissimilar incentives of borrowersand savers, in a broader context it refers to the unrelated incentives of principles andagents (Jensen and Meckling, 1976). In a case of financial distress, borrowers arelimited liable; implying that they have incentives to alter their behavior by taking onmore risk than savers are willing to accept. Monitoring the borrowers’ behavior is timeconsuming, complex and expensive for individuals. In inefficient markets, financialintermediation is beneficial since banks have lower monitoring and transaction coststhan individuals, due to economies of scale and scope.

.......

2.2 Rational for Regulation and Supervision

Moral threat states to changes in behavior when entities are assured or partial liableto sufferers. In the context of the banking sector, it states to a changing behavior interms of risk taking since the weakness sufferers for banks’ owners (e.g. shareholdersand member) are partial to the amount of equity financed whilst the upside potential ofrisk taking is clear. Given the fact that the weakness sufferers are controlled by a putoption value arising from the partial liability, banks could maximize shareholder valueby taking on more risks than depositors are willing to accept. According to Rime (2001),excessive risk taking and possible shortfalls (bankruptcies) are partly born by depositorsand the deposit insurance schemes. Moreover, the past years have shown that ownersare often supported by government interventions to dodge a collapse of the bankingsector. Monitoring banks would be essential to dodge excessive risk taking and toprevent a bank fiasco or even a systematic fiasco of the banking sector (Saunders et al.,1990). A systematic fiasco of the banking sector is highly undesirable given the centralrole of financial institutions in current economy. Some researchers argue that the moralthreat problem is less significant than regulators assume and state that the moral threatproblem does not fully explain the relationship between bank capital and risk taking.Following Milne and Whalley (2001) one should take into account possible futurestreams of income earnings and the fact that shareholders rarely extract maximumpayouts from banks. These things confine the moral threat problem.

........

CHAPTER 3 LITERARTURE REVIEW......27

3.1DETERMINANT OF BANK PROFITABILITY ........27

3.2LITERATURE ON MICROECONOMIC DETERMINANTS ..........27

3.3 LITERATURE ON MACROECONOMIC DETERMINANTS..........35

3.4LITERATURE ON ACCOUNTING CONSERVATISM....40

3.5LITERATURE ON EARNING PERSISTENCE.........44

CHAPTER 4 CONCEPTUAL FRAMEWORK.......46

4.1THEORETICAL FRAME WORK FOR BANKSPROFITABILITY.........46

4.2THEORETICAL FRAMEWORK FOR ACCOUNTING CONSERVATISM MEASURES ......49

4.3THEORETICAL FRAMEWORK FOR EARNINGS PERSISTENCE.......54

CHAPTER 5 BANKS PROFOTABILITY....59

5.1DETERMINANT SELECTION..........59

5.2DEPENDENT VARIABLES.......59

5.3 INDEPENDENT VARIABLES ....60

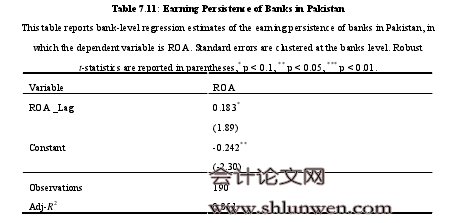

Chapter 7 Earning Persistence

The aim of this part of thesis is to find out the relation between economic variables,including GDP, inflation, financial crisis and interest rates and earning persistence. Atthe same time the impact of bank internal variables including size of banks and fundingcost on earning persistence. Specifically, we test the Pearson correlation between thevariables to find out their relationship with each other and regression test by applyingFreeman et al (1982) model to find out whether these variables have significantrelationship with each other. For this we take data form Pakistani banking sector fromperiod 2006 to 2012 and macroeconomic data from websites of ADB and IMF.

7.1 Data and Research Design

The banks data are collected from the database of State Bank of Pakistan andKarachi Stock Exchange. SBP is central bank in Pakistan and also the regulatoryauthority which sets rules for banks also have the financial information of all bankswhich are working in Pakistan. KSE is the Pakistan largest stock exchange where all thebanks are listed that we used in our study. The financial information is derived frombalance sheets, income statements and notes from the annual reports. Data formacroeconomic variable such as GDP, inflation and interest rates are obtained fromwebsite of IMF andADB.

......

conclusion

The findings show that the cash flow from operation to assets has positive effect onbanks profitability in our study. The positive effect can be explained that banks inPakistan during the study period are generating cash by efficiently utilizing the mainassets of banks.Findings about funding cost shows the significant negative effect on profitability ofbanks in our study, that can be explain that either banks in Pakistan are not raisingcheap fund or management is not able to convert cheap fund into profitability. Itdepends on the ability of banks to charge the interest expense on customer deposits toits borrowers on the asset side of the balance sheet. When banks are able to use amarkup pricing strategy the funding costs are charged to its customers and then thefunding costs are itself not a determinant of banks’ profitability. Banks size also hassignificant effect on banks profitability when i divide the banks into large size banksand small size banks, for large size banks it has been found that size is important factorsin explaining banks profitability. This can be explain that large banks focus more onprofitability and small banks are more focusing on their growth even at the expense ofthe profitability. They usually want to focus on market share.#p#分页标题#e#

............

References (omitted)