1. Introduction

1.1Background

As we all know, company can refinance through debt or equity. No matter whatrefinancing methods companies take advantage of, there will be an effect on thecompany’s value which can be reflected on the stock price. As a typical financinginstrument, convertible bond can be viewed as the mixture of bond and equity, beforeconversion investors are creditors and after conversion investors becomesshareholders. Meanwhile, even though CBs possess stock component, but it isconditional, so compared with traditional equity financing, the dilution effect of CBsbrought by refinancing is smaller than that of stock, resulting in smaller fluctuation ofstock price.So I want to study the effect of convertible bond issuance in this paper.As a complicated financial instrument,convertible bond possesses the componentsof both bond and stock. For the listed companies that have further financing need,compared with other financing instruments convertible bond has many advantages. Thebiggest one is low financing cost. Firstly, compared with general corporate bonds, thecoupon rate of CB is smaller because there is a call option behind it. Secondly, theinterest is paid before tax so there is tax shield effect without conversion. Last but notthe least, once converted into stock, there is no pressure to pay backprincipal.Considering the lower financing cost, small and medium-sized enterpriseswith high credit rating in US issue convertible bond to raise fund, which is a littledifferent in China. Because the credit market development is not perfect and directfinancing is so limited and difficult in China, issuers of convertible bond are all largeand medium-sized enterprises with high credit rates.

......

1.2Motivation

It is very meaningful to study the announcement effect of convertiblebonds.Generally speaking, there are two aspects for the development of CB’s market.On the one hand, if we can make it clear that how the listed companies’ fundamentalinformation and CBs’ term affect the abnormal return, we can provide helpfulsuggestion for CBs issuance if the companies want to keep the stock price stable.They should pay special attention to the factors that affect the abnormal return.On theother hand, acquiring the general sense of CBs’ issuance effect will provide rationalinvestment suggestion to investors.As an important financing instrument, the research on the wealth effect ofconvertible bond issuance is very important and meaningful. For the early begin ofcapital market in foreign countries, there are many foreign scholars having done avariety of researches on this topic. Compared with the foreign research situation andresult, current domestic research ismainly focused on pricing and simple qualitativeanalysis. Chinese capital market system is very complicated, however domesticresearch didn’t take it into consideration.In view of this, based on the existing theoretical and empirical researches, we willanalyze the issuance effect of CB by assign them into different groupsaccording to(1)the issuance timing, (2)it is a bond-like CB or equity-like CB, (3)whether theconversion option is traded separately. Besides, I will try to provide reasonableexplanation for the wealth effect under different situation.Then I will conductregression for abnormal return on 2 aspects: company fundamental element and CB’sterm.

........

2. Literature Review

2.1The Theoretical Model of Impact on Stock Price ofCompanies’Refinancing

Because capital market started early in the developed countries, foreign scholarshave developed a variety of theoretical models to explain the impact on stock price ofcompanies’ refinancing, includingthe optimal capital structure hypothesis, leveragehypothesis, signal hypothesis and free cash flow hypothesis.The optimal capital structure hypothesis thinks that there is an optimal capitalstructure for the company which means the existence of optimal ratios between thecompany's assets and liabilities. To make it simple and clear: there is anoptimal capitalstructure that can maximum the company value. If the debt ratio is too high, companywill face higher financial pressure and larger financial risk.So refinancing of listedcompanies via either debt or equity will change the capital structure and then impactthe company value.Refinancing by debt is an indicator that the company's financial strength is veryhigh, so the issuance of bonds will pass good signals to the market. Meanwhile, debtfinancing will avoid the dilution caused by the issuance of stock and take advantage ofthe tax-efficient. So generally speaking debt financing will have a positive effect on thestock price and equity financing will have a negative one.Considering CB’s character of the bond and stock combination, the effect ofissuance of CB is between the impact the debt financing and equity financing.

......

2.2Empirical Research Result

Many foreign scholars also did empirical research on this topic. In the US market,Smith (1986) show that CB financing has significant -2.07% effect on the market,lower than equity financing (-3.14%) and higher than debt financing (-0.26%).Kuhlman and Radcliffe (1992) found significant negative correlation betweenannouncement effect and equity value by using CPratio (conversion price ofsecurities/market prices of ordinary shares). Brennan and Her (1993) found -2.2%effect during the issuance announcement period [-1, 0].In recent years, researches on other developed markets have graduallyexpanded.Burlacu (2000) found that CB issuance has negative effect on the Frenchmarket and the results supported the MM theory.Abhyankar and Dunning (1999)examined 261 CBs issued during 1982 and 1986 in British market and found that CBissuance have significant negative effect on the shareholders’wealth.Kang and Stulz (1996) studied the561 Japanese CB samples between 1985 and1991 and found significant positive effect and they thought the different effect is causedby deregulation and specific form of Japanese companies. Roon and Veld (1998)investigated 47 samples in Dutch market between 1976 and 1996 and found the positivecorrelation is not significant.

.......

3. Research Method and Data....... 11

3.1 Research Method ......... 11

3.2 Data Source and Screening Criteria ....13

3.3 Definition and Calculation Formula of Variables Related ......16

3.4 Significant Test ......18

4. Empirical Test and Outcomes.........19

4.1 Empirical Test and Outcomes for Whole Sample .......19

4.2 The Impact of Bond and Stock Component ....22

4.3 The Impact of Split Share Structure Reform.........24

4.4 The Impact of Separately Traded CBs ......26

4.5 Cause Analysis for the Announcement Effect .......29

4.6 Robust Test ......35

4. Empirical Test and Outcomes

4.1Empirical Test and Outcomes for Whole Sample

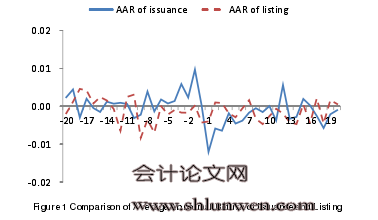

After the calculation mentioned above, I can get the AAR during 20 days beforeand after the issuance and listing announcement day, as we can see in the figure below.Generally speaking, AAR fluctuates around 0. We can see for issuance, AAR dropsfrom positive to negative during 1 day before and after the announcement date. Forlisting, there is a small decrease trend. The negative AAR of issuance announcement islarger than that of listing announcement, which indicate that market have digested someinformation at the listing announcement date compared with issuance.There exists adownward trend for both issuance and listing. Afterwards let’s compare the averagelevel of AAR for the days before and after the announcement date. For issuance, theaverage level before and after the announcement date is corresponding 0.0013 and-0.0026. And for listing, the average level before and after the announcement date iscorresponding -0.0007 and -0.0016. Besides, I will do statistics analysis on each day’sAAR.

......

Conclusion

Based on the data of convertible bonds issued from 2002 to 2013, this papertested the announcement effect on both the issuance data and listing date, findingthere is significant negative effect for issuance. Besides, we can see the negative AARof issuance announcement is larger than that of listing announcement and the negativeeffect for issuance is significant while that for listing is not significant, indicating thatmarket have digested some information for listing compared with issuance.Meanwhile,longer the research period, larger the negative effect, which means market digest theinformation gradually and Chinese capital market is not an efficient one.Using delta, I divided the sample into 3 groups to study the relationship betweenthe stock components of convertible bonds and the announcement effect. Afterresearch, I found issuance of bond CBs have larger negative effect when we look at theCAAR for the period across the announcement date than hybrid CBs and stock CBs.Asthe existence of asymmetric information theory, higher negative effect of CBs withbond components implies that in domestic capital market, equity financing ispreferred to debt financing.According to whether the CB issuance is before or after the completeness of splitshareholder structure reform, I divided the sample into 2 groups. The fluctuation ofabnormal return after reform is larger than that before reform and also the negativeeffect is larger for the issuance after reform. Two points mentioned above implies thatafter split shareholder structure reform, market is more sensitive to information.

............

References (omitted)