CHAPTER ONE: INTRODUCTION

1.1 Overview of Togo's Economy

The economy of Togo has undergone difficult times for 15 years from 1990 to 2005, the period ofsocio-political crisis. This has resulted in an economic stagnation since the rate of economic growth inreal terms has averaged 1.06% per year which is below the average annual demographic growth rateof 2.4% and the real per capita GDP was falling by around 5% all over a period between 1999 and2003 (World Trade/ Trade Policy Review Paper, WT/TPR/S/166). The Autonomous Port of Lome(PAL), a deep-water port is Togo's main comparative advantages in the sub region's marine transittrade but the poor infrastructure development, like road and rail networks,leads to this asset not beingfully exploited to the advantage of the country. Togo is one of the world leading producers of phosphateand this coupled with the comparative advantage in the transit trade should have transformed theeconomy with a population of less than 7 million people but due to socio-political crisis and otherfactors Togo remains one of the poorest country in the world. After independence in 1960, Togo has witnessed two military coup d'etats in 1963 and 1967 and hassince become a uni-party system country where there is only one political party “Rassemblement duPeuple Togolais" (RPT) and every citizen of the country is mandated to be a member. The wind ofdemocracy that blew over most sub Saharan African countries in the early 1990s never left Togo out.The population was advocating for a multi-party system and this resulted in demonstrations andindustrial strikes. The government therefore opened a national conference to dialogue with thestakeholders in the country and this led to the formation of many political parties. The stakeholderswere demanding the immediate resignation of the then president, Gnassingbe Eyadema, a demand thathe never considered valid.

………

CHAPTER TWO: LITERATURE REVIEW

2.1 Economic Growth

Generally,economic growth is an increase in the capacity of an economy to produce goods andservices over a period of time. It is measured as the rate of increase in an economy's Real GrossDomestic Product (Real GDP) over a period of time. A slow increase in an economy's Real GDP willresult in an economic stagnation whereas a decrease in its Real GDP will lead to an economic crisis.Economic growth is not only about an increase in productive capacity but also an improvement in thequality of life and material well-being of the people in that economy. An increase in the growth of theratio of GDP to population (GDP per capita), also known as per capita income,is referred toas intensive growth whereas an increase in GDP growth caused only by increases in demography isreferred to as extensive growth. Growth mostly arises from accumulation of physical capital aad themost efficient use of resources. The Classical growth theory was propelled by Adam Smith, Ricardo David, Robert Malthus and AUynYoung. This theory basically argues that economic growth will cease because of the increasingpopulation against a limited resources. They believe tihiat a temporal increase in real GDP per personwill cause the population to explode and this will consequently reduce real GDP. Adam Smith (1976)identified three major sources of growth, namely the growth in labour force and stock of capital, theimprovement in the efficiency with which capital is used through division of labour and technologyprogress,and the promotion of foreign trade that widens the market He asserts that an effectivedivision of labour will contribute to the growth of national wealth, a higher ratio of productive labourto total labour as well as an increase in labour productivity. Adam Smith and some scholarsemphasized that International Trade,Low transport cost and a well-ftinctioning market system are keyto rapid economic growth.

………..

2.2 Overview of Foreign Direct Investment

Foreign Direct Investment (FDI) is seen as a channel through which capital and technology are spreadfrom one country to another through the purchase or construction of tangible assets (land,factories,machineries and enterprises). It is also seen as a long term participation in management, joint-ventures,transfer of technology and expertise between the countries involved. According to the OECD standard definition, FDI is seen as “an international investment that reflectsthe objective of obtaining a lasting interest by a resident entity in one economy (‘direct investor') inan entity resident in an economy other than that of the investor (‘direct investment enterprise’)” (OECD,1996: Pg.7). This lasting interest means the existence of a long-term relationship between the directinvestor and the enterprise and a higher degree of influence on the management of the enterprise. FDIcomes mainly in two different ways. Investors establish a totally new company or invest in or partiallybuy an existing company through a merger or acquisition. FDI can be classified either as vertical orhorizontal; Cave (1971). Villaverde and Maza (2011) in their work "FDI in Spain: regional distributionand determinants explains the difference between vertical and horizontal FDI. According to them,Vertical FDI arises when a company moves its production chain upstream or downstream, that is, itlocates different stages of production process to different countries. On the other hand. Horizontal FDIarise when a company develops the same production process in the host country as in some othercounties. FDI can also be said to be outward (or outflow) if the host country invests in a foreign countrywhile an inward (or inflow) FDI is where a foreign country invests in the host country.

………..

CHAPTER THEE: DATA SPECIFICATION AND ECONOMETRICMETHODOLOGY........ 20

3.1 Data Specification........ 20

3.2 Econometric Methodology — VAR........ 24

CHAPTER FOUR: EMPIRICAL RESULTS ANDINTERPRETATIONS........ 29

4.1 Stationary Test ........29

4.2 Cointegration Result........ 30

4.3 VectorAutoregressive Model........ 30

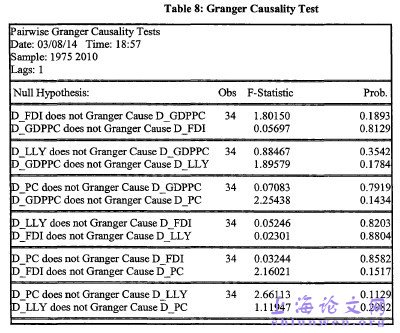

4.4 Granger Causality Test ........32

CHAPTER FIVE: CONCLUSION AND POLICYRECOMMENDATIONS........ 34

5.1. Conclusion........ 34

5.2 Policy Recommendations........ 34

CHAPTER FIVE: CONCLUSION AND POLICY RECOMMENDATIONS

5.1 Conclusion

The main objective of this work is to investigate the relationship between Foreign Direct Investment,Financial Development and Economic Growth of Togo and went a step furtiier to find if there exist agranger causality between the variables. A 36 observations of annual time series data from 1975 to2010 is used in the study. The time series data appear to be non-stationary at level but becamestationaiy at I (1) after running the unit root test using the Augment Dicker-fuller test on their 1stdifferences. A test of cointegration was done on the level of the time series to investigate whether thereis a cointegrating relationship between the variables. The result shows that the variables are notcointegrated which implies that there are no long term relationship between the variables. This resulthas prompted us to use the Vector Autoregressive Model. There is no statistical evidence to supportthe fact that, in the short run, a change in the regressors will help predict a change in the respectivedq>endent variables. A fiirther test to find out whether variables in the study can be useful inforecasting each other. The result shows that no granger causality, in any direction, exist betweenForeign Direct Investment, Financial Development and Economic growth. Clearly, the result fromgranger causality are supportive of those from the VAR analysis. A similar result was found on Nigeriaby Adeniyi et al (2012) in their paper "Foreign Direct Investment, Economic Growth and FinancialSector Development in Small Open Developing Economies" using the same VAR Model.

……….

Conclusion

The main objective of this work is to investigate the relationship between Foreign Direct Investment,Financial Development and Economic Growth of Togo and went a step furtiier to find if there exist agranger causality between the variables. A 36 observations of annual time series data from 1975 to2010 is used in the study. The time series data appear to be non-stationary at level but becamestationaiy at I (1) after running the unit root test using the Augment Dicker-fuller test on their 1stdifferences. A test of cointegration was done on the level of the time series to investigate whether thereis a cointegrating relationship between the variables. The result shows that the variables are notcointegrated which implies that there are no long term relationship between the variables. This resulthas prompted us to use the Vector Autoregressive Model. There is no statistical evidence to supportthe fact that, in the short run, a change in the regressors will help predict a change in the respectivedq>endent variables. A fiirther test to find out whether variables in the study can be useful inforecasting each other. The result shows that no granger causality, in any direction, exist betweenForeign Direct Investment, Financial Development and Economic growth. Clearly, the result fromgranger causality are supportive of those from the VAR analysis. A similar result was found on Nigeriaby Adeniyi et al (2012) in their paper "Foreign Direct Investment, Economic Growth and FinancialSector Development in Small Open Developing Economies" using the same VAR Model.

…………

Reference (omitted)