CHAPTER ONE (1) INTRODUCTION

1.3 Problem Statement

Although the Theo bromine bean (Cocoa) is alien to the West African sub-region, the sub-region, however, has assumed the leading role in the production of Cocoa. The cocoa industry in West Africa is highly competitive. This is because these countries seek to enhance food security, mitigate the harm of poverty and boost their export-based crop cultivation to earn optimum foreign exchange to support growth and development (15).

Ghana by 1911 became the largest producer of cocoa with export volumes of 41,000 metric tons. The 1920s, further witnessed massive improvement as Ghana produced 165,000 – 213,000 metric tons, and added approximately 40% of the aggregate global cocoa production. The (1938-1964), period saw an erratic, slow and unproductive, growth in cocoa production in Ghana, and by 1967, Ghana lost her place as the top producer of cocoa beans in the world. The retro (1967-1982) further witnessed low yield as a result of the plague of swollen shoot disease of cocoa. In the 1970s, cocoa production in Ghana nearly came to standstill. However, the sector was rescued and had some expansion, with the introduction of the Economic Recovery Program (ERP), and with the aid of the World Bank Cocoa Rehabilitation Project. The year 2000s saw transformed efforts to further increase growth in cocoa production in Ghana. Ghana Cocoa Board (COCOBOD) introduced the High Tech (HT), and the Cocoa Disease and Pest Control (CODAPEC) programs to curb the drop in harvests and to increase output to a mark equal to one million tons of beans (1). As a result, Ghana‟s total cocoa output increased from 400,000 tons in 1999-2000 to 700020 tons and 879348 tons in 2011 and 2012 respectively. Currently, Ghana‟s production volumes account for about 17% percent of total world supply making Ghana the second leading producer of the cocoa beans. Although, The excellence of Ghana‟s cocoa beans has turn out to be the global benchmark against which all cocoa is measured, and also attracts premium rates of 3.0 to 5.0 percent in relation to Côte d‟Ivoire the leading producer of cocoa beans in the world (17), Ghana has failed to regain her glory as the biggest producer of Cocoa in the world. Ghana‟s present state can best be described as stagnant since, for six years (2012 - 2017), no significant increase in production volumes has been recorded. It is obvious that Ghana‟s cocoa beans production and export is fast reducing which calls for swift measures. This can only be done when the sector is well analyzed in order to identify the variables that need much attention. Hence, the study analyzes the export competitiveness of Ghana‟s cocoa industry within the West African Sub-region.

加纳可可产业出口竞争力评价分析目录

CHAPTER THREE (3) METHODOLOGY

3.1 Description of the Study Area

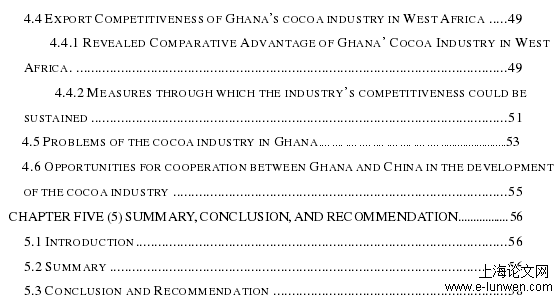

The focus of the research is Ghana; however, reference is made to other cocoa growing countries in West Africa. As shown in figure 4 below, data from eight countries were used for comparative analysis. Those countries are painted yellow in the map below. Ghana is a country on the Gulf of Guinea in close proximity to the equator. Geographically, Ghana is located on latitudes 4°45‟N and 11°N, and longitude 1°15‟E and 3°15‟W. Ghana shares boundaries with Burkina Faso to the North, the Southern border of Ghana is the gulf of Guinea, and the West and East of Ghana are Togo and Cote d‟ Ivoire respectively. Ghana occupies total land marks of 238,535 Km2, which is dominated by forest and grassland. Ghana is blessed with a very good topography with good plains, water falls, low hills, rivers, Islands and the World largest man-made lake.

Based on the rainfall pattern, soils, and the crops that are grown in various parts of the country, Ghana is put into six agro ecological zones: The tropical rain-forest in the south western region with high rainfall of up to 22000 mm; The Sudan Savannah in the north eastern area with rainfall of approximately 1000mm annually. The deciduous forest in the middle belt with rainfall of 1500mm annually; the Guinea Savannah in the northern regions with rainfall of 1100mm annually; the Transitional zone with an annual rainfall of 1200mm; and the coastal savannah which is characterized by convectional rainfall due to the nearness to the water body.

Figure 4: West African Map showing cocoa growing countries colored in yellow

.....................

Figure 4: West African Map showing cocoa growing countries colored in yellow

CHAPTER FIVE (5) SUMMARY, CONCLUSION, AND RECOMMENDATION

5.3 Conclusion and Recommendation

For all intents and purposes, the study examined the export competitiveness of Ghana‟s cocoa industry in West Africa. Ghana‟s export values were compared with the export values of Cote d‟ Ivoire, Nigeria, Cameroon, Sierra Leone, Liberia and Guinea from 1999 to 2018. The Revealed Comparative Advantage and the Revealed Symmetric Comparative Advantage indices were used as method of determining the export competitiveness. The study findings revealed that although the production volume of Ghana‟s cocoa is low compared with Cote d‟ Ivoire, Ghana is exceedingly good in cocoa beans export. Ghana‟s export of cocoa beans is strongly influenced by the volume of cocoa beans produced and the world consumer price of cocoa beans, farm gate price of cocoa in Ghana, and government policies and programs. Ghana‟s RCA and RSCA figures show that Ghana has out-competed the other major producers and exporters of cocoa beans in the West African sub-region. This is because Ghana export very good quality cocoa beans and also as a result of the increasing government spending‟s to boost the sector performance. Ghana is recognized globally for producing excellent cocoa. The COCOBOB police the entire cocoa value chain right from the point of production to the sales point in order to maintain excellent. Nonetheless, some major constraining factors such as unproductive aged cocoa trees, corruption in the governance and management of the cocoa industry, cocoa land lost, price determination issues,pest and disease infestation, inadequate logistics and inputs supply, bush fires, cocoa trafficking, cocoa price instability, national and international protocols, inefficient capacity building of farmers and cocoa workers, and low government expenditure. Ghana needs to work on its ailing cocoa yields and production output by overcoming these problems, in order to boost its annual cocoa yield and productivity so as to sustain its gains going forward. Based on expert responses, the study findings show that there are five major areas that require much attention in order to sustain the cocoa industry. They include: Boost cocoa production by planting hybrid and climate smart cocoa trees, provision of improved chemicals and control of pest and diseases. Increase the quality of cocoa through improvement of the harvesting and drying techniques, and maintain standards and certification, boost local processing technology in the various cocoa growing regions, Improve cocoa cultivation and production infrastructure, and build the capacities of farmers, and Increase government budget for the cocoa sector, and also enter into partnership with other producing countries to establish commodity market in West Africa.

reference(omitted)