Chapter 1: Introduction

1.1 Background and Significance

The first two decades after Bangladesh's independence in 1971 were the mostdifficult times in the economic history of the country. In 1970s, Bangladesh wastrying to recover from the devastating effects of war, cyclones, floods, and famines,and the 1980s were dedicated to consolidating successes in restoration andreconstruction. During this period, economic growth remained slow as GDP grew lessthan 4 percent per year, while population growth remained relatively high, which wasat more than 2 percent. As a result, per capita income grew very slowly – in over 1.5percent a year. There was a modest improvement in growth around national income inthe 1980s, which is entirely due to population decline. It is not due to the growth ofGDP without any substantial trend. Bangladesh's GDP growth rate exceeded theworld average in the second half of the 1980s and has remained the same trend sincethen. Investment and savings as a percentage of GDP have steadily increased since themid-1980s. Rahman (2003) identifies economic growth factors that may be workingat the same time. The average growth rate of the service sector across all decades andacross appears to be about the same. One of the notable features of the growth processis the tremendous volatility of 1974-1990 GDP growth, agricultural value-added, and the industrial value was added. Therefore, the period after the reform is stable athigher growth rates. Economic policy has long been aimed at combating poverty byincreasing food production and strengthening education while developing anindustrial and technological base, but severe floods often upset development plans.

国际贸易毕业论文范文

...................

Chapter 3: The Connection between Growth and Inequalityin Bangladesh

3.1 The Effect of Growth on Income Inequality in Bangladesh

The impact of growth on income distribution and the time course of thisrelationship will also be investigated. G.Ramey and V. A. Ramey (1995) mentionedhigh volatility growth rate leads to lower average growth rate. According to theresearch of Hausman and Gavin (1996), Latin American countries were volatile, andthere was inequality in income distribution. The results presented will review thesefindings here. Growth rate volatility turns out to be a determinant, not average growthof income inequality.

The purpose of this study is to verify that the results found in the existingempirical literature are reliable in the consistent measurement of the incomedistribution. Therefore, it may be desirable to estimate the formula as close as possiblefor comparability may be used in the existing literature.

Our focus is on growth volatility inequality, not the effect of growth oninequality. An analysis of the impact of output volatility on income inequality, Breenand Garcia-Penarosa, includes the logarithm of the initial GDP and its square in theregression with a standard deviation of production growth. The initial value of GDPand its area lose value when release volatility included. So, in regression, includesonly output growth volatility. Therefore, our regression can’t test Kuznets hypothesisand we do not contribute to the literature we investigate impact of development levelon income inequality. Average growth rates, public expenditure as a ration of GDP,Per capita income, Poverty rates, Unemployment rates, and Inflation rates in growthare include as potential determinants of income inequality.

...........................

Chapter 5: Results and Discussion

5.1 Granger Causality Test Result

To test the causal relationship between economic growth and inequality, weimplemented Granger causal test on them, the sample interval is from 1983 to 2018.Granger (1988) stated that the Granger test is only available when the variablesinvolved are either stationary or non-stationary but are co-integrated. In our study, wehave shown that all variables (before the first difference) are non-stationary, but afterthe first difference they are stationary, and they are inter-integrated in the long run.Therefore, the Granger test can be performed and the results are shown in Table-

Chapter 3: The Connection between Growth and Inequalityin Bangladesh

3.1 The Effect of Growth on Income Inequality in Bangladesh

The impact of growth on income distribution and the time course of thisrelationship will also be investigated. G.Ramey and V. A. Ramey (1995) mentionedhigh volatility growth rate leads to lower average growth rate. According to theresearch of Hausman and Gavin (1996), Latin American countries were volatile, andthere was inequality in income distribution. The results presented will review thesefindings here. Growth rate volatility turns out to be a determinant, not average growthof income inequality.

The purpose of this study is to verify that the results found in the existingempirical literature are reliable in the consistent measurement of the incomedistribution. Therefore, it may be desirable to estimate the formula as close as possiblefor comparability may be used in the existing literature.

Our focus is on growth volatility inequality, not the effect of growth oninequality. An analysis of the impact of output volatility on income inequality, Breenand Garcia-Penarosa, includes the logarithm of the initial GDP and its square in theregression with a standard deviation of production growth. The initial value of GDPand its area lose value when release volatility included. So, in regression, includesonly output growth volatility. Therefore, our regression can’t test Kuznets hypothesisand we do not contribute to the literature we investigate impact of development levelon income inequality. Average growth rates, public expenditure as a ration of GDP,Per capita income, Poverty rates, Unemployment rates, and Inflation rates in growthare include as potential determinants of income inequality.

...........................

Chapter 5: Results and Discussion

5.1 Granger Causality Test Result

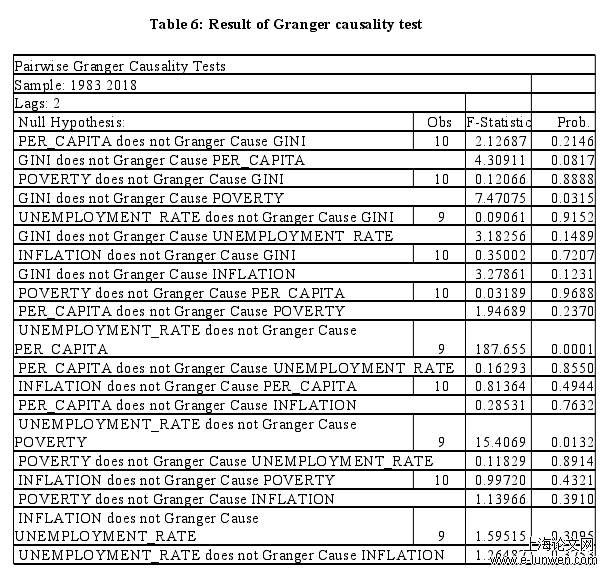

To test the causal relationship between economic growth and inequality, weimplemented Granger causal test on them, the sample interval is from 1983 to 2018.Granger (1988) stated that the Granger test is only available when the variablesinvolved are either stationary or non-stationary but are co-integrated. In our study, wehave shown that all variables (before the first difference) are non-stationary, but afterthe first difference they are stationary, and they are inter-integrated in the long run.Therefore, the Granger test can be performed and the results are shown in Table-

Table 6: Result of Granger causality test

The conclusions from the Granger causality test are: firstly, for the nullhypothesis “PER_CAPITA does not Granger Cause GINI”, the probability value of F-statistic is 0.2146>0.05(in the 5% level of significance). Thus, we accept thishypothesis and believe that per capita is not Granger cause of Gini; Secondly, for thenull hypothesis, “GINI dose not Granger cause PER_CAPITA” the probability of F-statistic is 0.0817>0.05. Therefore, the null hypothesis is accepted and the Gini is notGranger cause of per capita.

...........................

5.2 Discussion

The results I find provide answers to the questions in my study on the impact ofeconomic growth on income inequality in Bangladesh. As I know, the value of theGini coefficient lies between 0 and 1, where 0 means perfect equality, and 1 meansperfect inequality in the distribution of income. Therefore, the economic interpretationof the results obtained from our regression analysis is that there is an important linkbetween economic growth and income inequality in Bangladesh. However, not allgrowth factors play a significant role in widening or narrowing national incomeinequality. As the results suggest:

An increase in poverty worsens income distribution (as an alternative increasesincome inequality because it increases the value of the Gini coefficient);

Conversely, unemployment and an increase in the number of personal per capitaonce in the country, income distribution improved (income inequality decreased)vice versa;

As for inflation, our empirical results show that it does not have a significantimpact on increasing or decreasing income inequality in Bangladesh.

The trend of economic development in Bangladesh is consistent with the theorygiven by Kuznet’s (1955) in the light of industrialization and the mechanicalizing ofagriculture in the during 1950s and 1960s. When the focus of development was on thecity, internal migration led to a kind of income disparity between the city and the ruralpopulation. But according to Kuznet’s, the subsequent growth of industrialization,democratization and welfare will benefit the people from the growing growth andreduce income inequality by increasing the per capita income.

.........................

Chapter 6: Conclusion and Recommendations

6.2 Recommendations from Six Perspectives

Economic growth is irresistible and inevitable. Growth can affect the countryboth positively or negatively. In any case, we should not just turn away and take it blindly. We must be prepared to plan, and we must formulate policies so that growthcan ensure sustainability in the development of our economy. We must take correctivemeasures to avoid the adverse effects of growth. We cannot allow our economy togrow in such a way that create hundreds or thousands of billionaires’ worth tens ofmillions ordinary people. Based on the results of this study, I would like torecommend the following measures taken by the Government of Bangladeshregarding income the problem of inequality while maintaining processes ofsustainable growth and development:

First, the implementation of progressive land reform and agricultural reformsshould be given priority in the state priorities, while continuing to provide private landin agriculture, the largest privately-owned manufacturing sector of the economy.

Second, the government must increase investment in education so that humanresources can grow to a global level. Governments also need to ensure access toquality education and introduce an apprenticeship system (for research and laborfacilities together) for the country's marginal mass.

Third, the government should control inflation, provide and improve a system ofprogressive taxation (intended for people with high incomes) to redistribute nationalincome so as not to impede economic growth. But Labor-intensive industries shouldbe excluded from this consideration.

Fourth, the review results show that there is a positive connection betweeneconomic growth and income inequality. This shows Bangladesh's growth is joined byfar-reaching inequality. Right now, the government needs to concentrate on poorexpert development, not simply on empowering economic growth. Poor expertdevelopment guarantees that all types of development advantage poor people and givethem instances of chances to improve their budgetary prosperity. The vast majority ofBangladesh's disparities are increasingly noticeable in country territories and spotswith low financial government assistance. Along these lines, the administration mustengage rustic networks by subsidizing ventures, building framework, producingincome, and making profitable exercises that will assist you with living better.

reference(omitted)

...........................

5.2 Discussion

The results I find provide answers to the questions in my study on the impact ofeconomic growth on income inequality in Bangladesh. As I know, the value of theGini coefficient lies between 0 and 1, where 0 means perfect equality, and 1 meansperfect inequality in the distribution of income. Therefore, the economic interpretationof the results obtained from our regression analysis is that there is an important linkbetween economic growth and income inequality in Bangladesh. However, not allgrowth factors play a significant role in widening or narrowing national incomeinequality. As the results suggest:

An increase in poverty worsens income distribution (as an alternative increasesincome inequality because it increases the value of the Gini coefficient);

Conversely, unemployment and an increase in the number of personal per capitaonce in the country, income distribution improved (income inequality decreased)vice versa;

As for inflation, our empirical results show that it does not have a significantimpact on increasing or decreasing income inequality in Bangladesh.

The trend of economic development in Bangladesh is consistent with the theorygiven by Kuznet’s (1955) in the light of industrialization and the mechanicalizing ofagriculture in the during 1950s and 1960s. When the focus of development was on thecity, internal migration led to a kind of income disparity between the city and the ruralpopulation. But according to Kuznet’s, the subsequent growth of industrialization,democratization and welfare will benefit the people from the growing growth andreduce income inequality by increasing the per capita income.

.........................

Chapter 6: Conclusion and Recommendations

6.2 Recommendations from Six Perspectives

Economic growth is irresistible and inevitable. Growth can affect the countryboth positively or negatively. In any case, we should not just turn away and take it blindly. We must be prepared to plan, and we must formulate policies so that growthcan ensure sustainability in the development of our economy. We must take correctivemeasures to avoid the adverse effects of growth. We cannot allow our economy togrow in such a way that create hundreds or thousands of billionaires’ worth tens ofmillions ordinary people. Based on the results of this study, I would like torecommend the following measures taken by the Government of Bangladeshregarding income the problem of inequality while maintaining processes ofsustainable growth and development:

First, the implementation of progressive land reform and agricultural reformsshould be given priority in the state priorities, while continuing to provide private landin agriculture, the largest privately-owned manufacturing sector of the economy.

Second, the government must increase investment in education so that humanresources can grow to a global level. Governments also need to ensure access toquality education and introduce an apprenticeship system (for research and laborfacilities together) for the country's marginal mass.

Third, the government should control inflation, provide and improve a system ofprogressive taxation (intended for people with high incomes) to redistribute nationalincome so as not to impede economic growth. But Labor-intensive industries shouldbe excluded from this consideration.

Fourth, the review results show that there is a positive connection betweeneconomic growth and income inequality. This shows Bangladesh's growth is joined byfar-reaching inequality. Right now, the government needs to concentrate on poorexpert development, not simply on empowering economic growth. Poor expertdevelopment guarantees that all types of development advantage poor people and givethem instances of chances to improve their budgetary prosperity. The vast majority ofBangladesh's disparities are increasingly noticeable in country territories and spotswith low financial government assistance. Along these lines, the administration mustengage rustic networks by subsidizing ventures, building framework, producingincome, and making profitable exercises that will assist you with living better.

reference(omitted)