Chapter1. Introduction

1.1 Research Background

The steel industry is one of the most important industries of the national economy, supplying the basic materials to other industries, which supports the national competitiveness and playing an important role in economic development. In addition, the supply of basic materials to all industries such as automobile, machinery, construction, shipbuilding, etc., is very closely related to all the industries. Automotive, shipbuilding, machinery and construction have played a pivotal role in the remarkable growth of the Korean and Chinese economies. These products played a major role not only in their own development but also in the development of the steel industry. Therefore, the steel industry has become a key industry for developing the economies of both Korea and China.(Guang, 2010).

Therefore, both the Korean and Chinese governments have fostered steel industry as a key industry in order to make the driving force of economic growth. Of course, Korea and China have different development processes and features. These two countries have developed the industry and have secured its position in the global steel market. Korea government has been managing and supporting until 1990s, when the steel industry was on track, through the five-year economic development plan. China has also become a powerful player in the global steel market since its founding through managed by Chinese government.

As such, steel industry, which is inseparable from all national industries, is an indispensable industry in a country that can be called the rice of industry.

...............................

1.2 Objectives of the Study

In a previous study (Chen, Roll and Ross, 1986), a comprehensive approach to comparison analysis between stock prices and main macroeconomic variables was initiated by identifying and verifying key economic conditions that affect stock prices (MCQueen and Toley, 1993) discusses the effect of economic variables on stock returns by economic conditions, and discusses the correlation between stock prices and economic variables.

The objectives of the research are,

First, The relationship between profit, stock price and main macroeconomic variables can help to predict the future performance of steel companies.

Second, in this uncertain steel market, we can find main macroeconomic variables that can impact the profit of steel companies and correlation with stock prices Thirdly, from this study, we can provide guidelines for governments and steel enterprises to make policy and run the steel enterprises smart and efficient..

Finally, we can provide suggestions and comments for both Korean and Chinese steel industries.

.................................

Chapter2. Literature Review

2.1 Theoretical Background

2.1.1 Research on Corporate Management Performance

Studies related to corporate management performance (profits) have been mainly focused on prediction of future management performance (profit) of a company. According to Albrecht (1977), Kim et al (1989). defined that it is not so meaningful statistically to predict future management performance, focusing on the possibility of using the time series data of past profit The following studies have been conducted focusing on whether there is a more predictive research method compared with the time series model.

To redeem this weakness, Park Chang Rae (2006) examined whether analysts' forecasting ability and using non-earnings accounting data other than profit data in the income statement.

Penm (1989) and Ou (1990) examined whether the non-earnings accounting data provide forward-looking information about changes in future earnings those are not included in earnings, and whether such information reflected in stock prices. Non-earning accounting data showed that it is highly related with future profits. We also showed that there is additional explanatory power for the stock price change in addition to the information provided by the earning accounting data.

...............................

2.2 Existing Research on the Relationship Between Main Macroeconomic Variables and Stock Price

Although no theoretical model has been established on the relationship between main macroeconomic variables and stock prices, comparison analysis has been actively conducted to examine the extent to which share prices respond to changes in main macroeconomic variables such as currency, interest rates, exchange rates, and real economic indicators.

Chen, Roll, and Ross (1986) find economic conditions that affect stock market returns, and the impact on asset prices. According to the theory of asset pricing by efficient market theory and rational expectation theory, asset prices are affected by state variables that explain economic conditions. The study, using data from 1958 to 1984, showed unexpected macroeconomic news We measure the relationship between economic news and stock returns in the system. The results show that industrial production (MP), unexpected inflation (UI), and unexpected risk premium have a significant relationship with stock returns over the whole period, while market indices have significant results over the entire period. Finally, this study suggests that stock returns are an unexpected It is concluded that prices are determined by the degree of their exposure to systemic economic news measured.

Lee (1992) examined the relationship between stock returns, economic activity, and inflation using the VAR model for the period from 1947 to 1987. The economic variables used are the six - step lag data of real stock returns, real interest rates, industrial production, and inflation.

.............................

Chapter 3: Research Methodology and Method............................. 14

3.1 Research Design ....................14

3.2 Adopted Models ............................15

Chapter 4: Overview of China-Korea Steel Industry ..................................... 21

4.1 Introduction of the Steel Industry ....................................21

4.1.1 Concept and Classification of Steel Industry .................................21

4.1.2 Characteristics of Steel Industry .............................22

Chapter 5: Comparison Analysis ...........................................51

5.1 Variable Classification .......................51

5.1.1 Net Profit .........................................51

5.1.2 Stock Price .....................................51

Chapter 5. Comparison Analysis

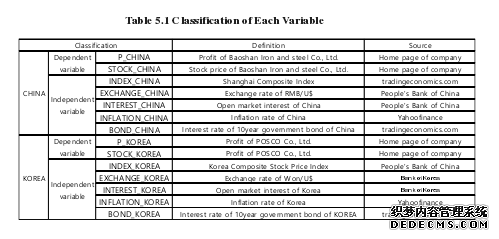

5.1 Variable Classification

5.1.1 Net Profit

Net profits are the profits earned by a management entity for a certain period of time for those investing in the company. This is a positive factor, so it is calculated by subtracting the passive factors: cost, losses to be deducted and income tax. . The net profits of companies are commonly used as variables to measure corporate performance.Net Profit = Revenue - (Expense + Income Tax)

........................

Chapter 6. Conclusion

6.1 Research Implications

This study examines the relationship between profit, stock prices of major steel companies in China and Korea and main macroeconomic variables. Then analyze the mutual relations among them to verify the sensitivity of major steel companies in each country. In addition, we try to help business executives and investors to making decisions based on our research results.

Five main macroeconomic variables, such as stock index, exchange rate, interest rate, inflation, and interest rate of 10-year government bonds, respectively. The analysis period was 10 years from January 2006 to December 2015, and quarterly data was used. The ADF test method was applied to set up a metric model those matched the characteristics of the time series data. The Johansen co-integration test was used to estimate the long-run equilibrium of the variables and the VAR model or VECM A dynamic analysis between variables was conducted using the model. In addition, we analyzed the correlation between the variables and the ripple effect according to the change of individual variables through the impact response analysis. In this study, the analysis was conducted under the assumption that main macroeconomic variables used in the analysis, steel profit and stock price are related. The results of this study are as follows.

reference(omitted)