财务学位论文哪里有?笔者根据2015年至2019年高铁印尼中国分公司(HSR Indonesia China)五年的数据分析和讨论结果,在与公司标准进行比较后,得出以下结论:在流动性比率、偿付能力比率和盈利能力比率方面,财务健康状况良好。高铁印尼中国的财务状况相对健康。据说该公司是一家相当健康的公司,因为这些公司具有良好的比率价值。从流动比率、速动比率、现金比率、负债与资产比率、负债与权益比率、长期负债与权益比率等比率来看,处于良好状态。因此,净利润率表现良好。与此同时,总资产回报率(ROA)即股本回报率(ROE)处于不健康状态,因为拥有的比率值低于比率的标准值。

CHAPTER 1 INTRODUCTION

1.1 Background and problem statement

The fourth paragraph of the preamble 1945 Constitution states that one of the Republic of Indonesia's objectives is to promote public welfare. The concept of welfare is, of course, inseparable from the necessary facilities and infrastructure. The provision of infrastructure is one of the fundamental sectors that must be realized in economic development to achieve general welfare. The infrastructure sector is expected to be able to support and drive economic activity. The availability of Indonesia's infrastructure stock to Gross Domestic Product (GDP) in 2015 was at 35 percent. This is still below global standards.

Apart from the availability of infrastructure, the quality of Indonesia's infrastructure is still low. To meet the need for infrastructure, it is necessary to have effective coordination between stakeholders, in this case, ministries, institutions, local governments, State-Owned Enterprises (SOE), and the private sector, to create a synergy for infrastructure projects implementation. National Strategic Projects (NSP) are projects that the government will implement, local governments, and business entities with a strategic character to increase growth and equitable development to improve community welfare and regional development.

The National Strategic Project is divided into ten programs, and this includes the Electricity Infrastructure Development Program, the Economic Equalization Program, the Border Area Development Program, the Exit Toll Access Road Development Program, the National Tourism Strategic Area Development Program, the Waste Processing Installation Program for Electric Energy, Smelter Development Program, National Food Supply Improvement Program (Food Estate), Superhub Development Program, and Regional Development Acceleration Program.

CHAPTER 3 OVERVIEW OF FINANCIAL ANALYSIS IN INTERNATIONAL PROJECT COMPANY

3.1 A brief introduction about the company being study

International Project Company is the compulsory company for this research. This international project company is considered to be the representative of many good companies in China and Indonesia. The company introductions below will describe some of the company's achievements and wherever they develop and innovate. Therefore, researchers are interested in knowing the company's financial health so that it can it into consideration for the future.

3.1.1 High-Speed Rail Indonesia China

HSR Indonesia China is a part of Indonesian society to build more than just transportation and offer more than just business by creating a harmonization and combination of transport and regional integration in a sustainable manner. Established in October 2015, HSR Indonesia China is a joint venture between a consortium of Indonesian State-Owned Enterprises through Pilar Sinergi SOE Indonesia and a consortium of Chinese railway companies through Beijing Yawan HSR Co. Ltd., with a business major in the public transportation sector with a business to business (B2B) scheme.

Present to develop the country's railroad mass transportation infrastructure, HSR Indonesia China is currently the Jakarta-Bandung Fast Train project owner, one of the Indonesian government's National Strategic Projects (NSP) Presidential Decree No. 3/2016. In addition to developing public transportation infrastructure, HSR Indonesia China also strives to support increased community productivity along the fast train line by developing integrated areas or Transit-Oriented Development (TOD) in each station area, namely Halim, Karawang, Walini, and Tegalluar. The TOD concept combined with the fast train is believed to increase the ease of restricted access to accelerate the surrounding area's economic growth.

CHAPTER 4 RESEARCH METHODOLOGY

4.1 Liquidity ratio

Liquidity Ratio is a ratio that shows the ability of a company to meet short-term obligations that must be fulfilled at the right time.

1) Current ratio

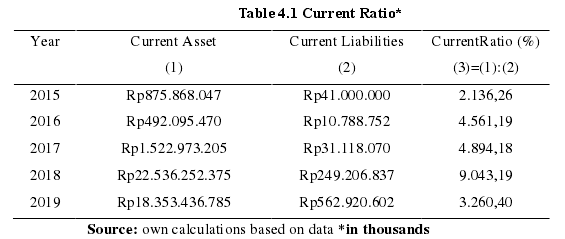

Financial analysis with current ratios obtained results as presented in Table 4.1 Based on the table; it can be seen that:

From the table of results of the liquidity ratio analysis that has been carried out, it can be seen that: In 2015, a Current Ratio was obtained of 2.136,26%, which means that every Rp1,00 of current debt will be guaranteed by Rp21,36 of current assets. In 2016 the Current Ratio increased to 4.561,19%, which means that every Rp1,00 of current debt will be guaranteed by the company's current assets of Rp45,61. In 2017 the Current Ratio was 4.894,18%, which means that every Rp1,00 of current debt will be guaranteed by Rp48,94 of current assets. In 2018 the Current Ratio increased to 9.043,19%, which means that every Rp1,00 of current debt will be guaranteed by Rp90,48 current assets. In 2019 the Current Ratio decreased to 3.260,40%, which means that Rp32,60 current assets will secure every Rp1,00 current debt.

4.2 Solvency ratio

1) Debt to Asset Ratio

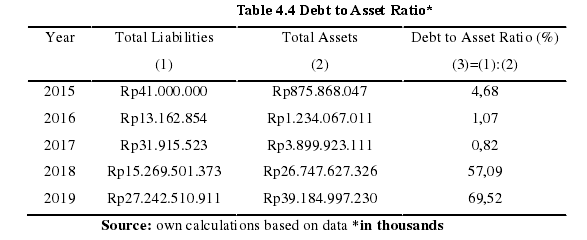

Financial analysis with a debt to asset ratio obtained results as presented in table 4.4. Based on this table. It can be seen that:

From the table of results of the Solvency Ratio analysis that has been carried out, it can be seen that: In 2015, a Debt to Asset Ratio was obtained of 4,68%, which means that every Rp1,00 of assets will be guaranteed by Rp0,04 of liabilities. In 2016 the Debt to Asset Ratio decreased to 1,07%, which means that every Rp1,00 of assets will be guaranteed by the company's liabilities of Rp0,01. In 2017 the Cash Ratio was 0,82%, which means that every Rp1,00 of assets will be guaranteed by Rp0,008 of liabilities. In 2018 the Debt to Asset Ratio increased to 57,09%, which means that every Rp1,00 of assets will be guaranteed by Rp0,57 liabilities. In 2019 the Debt to Asset Ratio increased to 69,52%, which means that Rp0,69 liabilities will secure every Rp1,00 assets.

CHAPTER 5 CONCLUSION AND SUGGESTIONS

5.1 Conclusion

Based on the results of data analysis and discussion that has been carried out at HSR Indonesia China for five years, from 2015 to 2019, it is concluded that the financial health condition in terms of liquidity ratios, solvency ratios, and profitability ratios and after being compared with company standards. HSR Indonesia China has a relatively healthy financial situation. The company is said to be a reasonably healthy company because these companies have a good ratio value. Judging from the ratios, namely the current ratio, quick ratio, cash ratio, debt to asset ratio, debt to equity ratio, long-term debt to equity ratio, it is in a good position. And for that, the net profit margin is in a good job. Meanwhile, the rate of return on total assets (ROA), the rate of return on equity (ROE), is in an unhealthy position because the ratio value owned is below the standard value of the ratio.

reference(omitted)